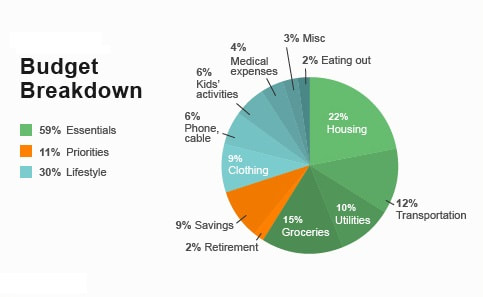

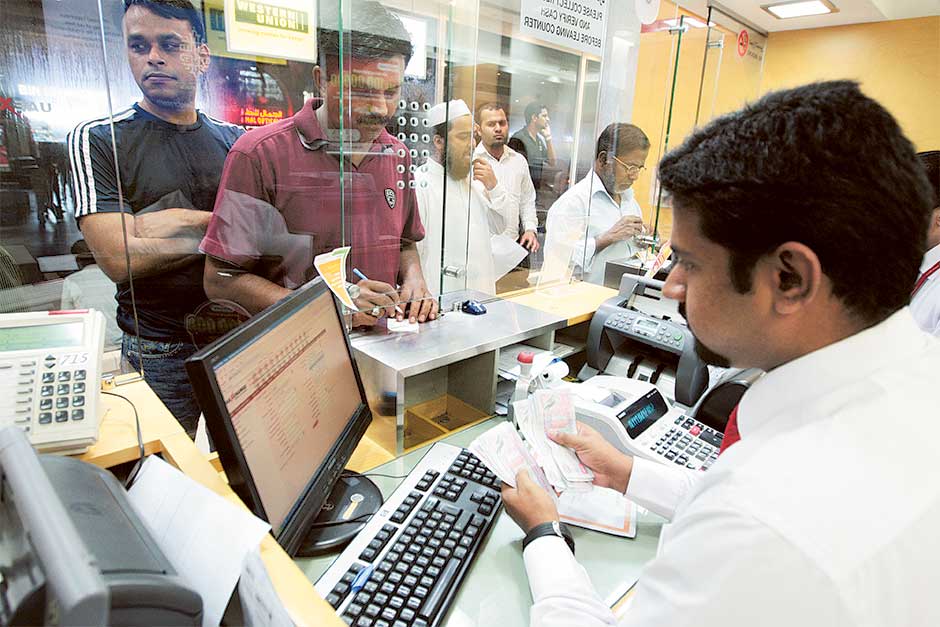

Expenses rising? Here's how to avoid getting broke in UAE - 36 tips to help you leave Dubai rich5/13/2018 Gulf News, UAE. 13th May 2018 Struggling to pay the bills and save money at the same time? Here's how to tackle rising cost of living. Many people struggle to keep up with rising costs, but there are ways to cut back and still save money. Dubai: The high cost of living is always a personal finance issue for many people in many parts of the world. Households constantly worry about how they can keep a roof over their heads, put food on the table or send their children to school without getting broke. Residents in the UAE are no exception. 36 tips to help you leave Dubai rich. If you don’t want to be another expat who goes back home without a penny to his name, it's high time you started saving now. Paul Butler, a father of three from the United Kingdom (UK), has been living in the Middle East for seven years now. But lately, he’s had to look at his lifestyle choices and consider cutting back on his family’s outgoings. One of his biggest worries is that the education fees for his two elder sons have just increased and he now has to shell out Dh160,000 on school bills alone. “This is a sizeable amount of money, what with the cost of living ever increasing. It meant we have had to cut back on most of the lifestyle choices we made when we came.” Nerisa, a mother of three from the Philippines, said their financial outgoings have indeed increased every year and this time, she and her husband have to spend Dh120,000 annually to send their three kids to school. “Everything seems to be on the rise, including the cost of groceries and housing rent. And on top of that, we have to pay a housemaid to help with the chores, and that’s another Dh30,000 yearly expense,” she said. We’re constantly forced to spend. Whether it’s rent, utility bills, food or petrol, these are expenditures you cannot get away from. If you’re a parent, then you can add some outrageous school fees to that too! So already we don’t have much to save and the little that we do, we end up spending mindlessly at the many malls that exist in this country. We’re all wired to consume. In the UAE this is magnified more so when you walk around any of its fancy shopping destinations. Advertisements give us all the more reason to upgrade and we constantly want the latest, fanciest, biggest and priciest. But stop and think for a moment. Rationalise. Once you’ve got a handle on that, we’re on our way to saving money to take home. Here are some money-saving tips we hope you’ll find helpful. 1. Start today Whether you start big or small, it doesn’t really matter – as long as you start. If you can’t save 10 per cent of your income, begin with just 5 per cent and live off the remaining 95 per cent. Save consistently, even before you pay your monthly bills and debts. Find a way to gradually increase your savings rate to 6 per cent, 7 per cent, 10 per cent, if not more. Ideally, you should put aside 15 to 20 per cent of your savings in an investment fund. What’s important is that you start now, and get into the habit of saving and investing. 2. Pay yourself first As soon as you are paid, split the money and put yourself on top of the queue. By paying yourself first, you get the satisfaction of saving something for a rainy day (or your retirement). If your salary gets deposited each month into your bank account, put some of that into a separate account which you won’t use for weekly groceries or personal expenses. You can do a split; say 50/50, 60/40, 70/30, 80/20 per cent for expenses/savings, whichever suits you best. What’s important is that you set a personal target of paying yourself first — and stick to it. 3. Keep two bank accounts Have one account for your expenses and have another one for your savings. It's a simple solution, and it’s rather helpful. Splitting the two allows you to keep tabs on your money better. This allows you not only to physically put your money in two places, but know the amount of money you have spent and saved up. Ideally, you should have more in your savings than in your expense account. 4. Make your money make you more money If you put aside Dh370 (about $100) per month – the equivalent of a cup of cappuccino a day – throughout your working life and invest it in a fund that earns 8 per cent to 10 per cent per annum, you will be financially independent, with savings of Dh3.7 million ($1 million) by the time you retire, according to “Way to Wealth” author Brian Tracy. Even someone who earns a minimum wage can be a millionaire if he or she consistently saves over the course of his lifetime. Learn how mutual funds, exchange traded funds, trust funds, insurance, 401(k) or "forced savings" plan, and personal investments. 5. Keep track of your finances Use a banking app on your phone (if it’s available) where you get a bigger view of your money, keep tabs of your balances, check your transaction history and transfer money in between accounts. Or you can go old school and write it in a book. What’s important is to keep track of how much is going in and going out. Keep track of how much goes where. This allows you to see if you’re overspending, so you can cut back on things and save money. 6. Save your change Whether you use a box, a can or a piggy bank, saving loose change is an amazing way to earn extra money. Your 25 or 50 fils or Dh1 coin can seem insignificant, but if you round them up later, you could easily end up with a few hundreds before you know it and then you can buy something you’ve been wanting for yourself or add it to your investment kitty. 7. Don’t keep money in your wallet This practice guards against your impulse to buy, especially from stores that still take cash-only payments. If you look into your wallet and know there’s money there, your instinct will tell you to spend it. So if you do find yourself without any cash when you walk into a store, it cuts your impulse to spend. You can’t spend what you don’t have. 8. Don’t convert currencies Converting everything you buy or want to buy into your home currency is silly. We’re not earning in pounds or dollars, so we shouldn’t be thinking in those currencies. Besides different countries have different prices depending on various economic factors. It’s a mistake that many expats make. 9. Don’t buy a tank With easy instalment plans and petrol being so cheap, walking into the 4x4 trap is not uncommon. But the amount you will end up paying in monthly instalments for a 4x4 compared to a regular car can work out to a difference of about Dh1,000. And let’s be honest, you just need a set of wheels to get you around from point A to B. 10. Avoid road tolls While getting a Salik tag is not very expensive and gives you the option of using Shaikh Zayed Road when necessary, you can avoid using it all the time. Shaikh Mohammad bin Zayed Road and Al Khail Road are as convenient and mostly free-flowing. 11. Avoid overspending on food Food is a necessity, but there’s no need to splurge. People tend to buy too much food, stocking their fridge with food that eventually goes straight in the bin. Saving money on food is as easy as preparing your lunch at home, instead of buying lunch at work. 12. Don’t waste food If you have ended up buying too much food, don’t throw it away. Improvise. Do what all the Nan’s in the world do… make a pickle. It’ll save you an expense on a day when you’re planning to have some friends over. You don’t have to rush out to Spinneys to buy some over-priced snacks. Slap some of that pickle on crackers and you’re sorted. 13. Buy quality Saving doesn’t mean not buying anything at all. When you do buy, go for quality over quantity. When you have a family, buy a quality couch that would stand the onslaughts of growing children. Invest in a nice bed, because you’ll spend a third of your life on it. Buy quality because it actually helps you save money in the long term. It’s the same when buying a car; buy cheap and you’ll end up spending more on repairs and replacements. 14. Achieve targets, reward yourself Even an occasional dinner at a nice place to mark a milestone in your savings plan can be helpful. When you do meet your target, buy yourself something you’ve wanted for a while. Having something that really motivates you helps you stay focused on your goal. 15. Do not borrow money Avoid spending money that isn’t yours. Avoid borrowing money from your parents, siblings or friends, although it’s sometimes inevitable. Owing money is not worth buying that thing you want. As far as possible, stay away from credit card debt, as they charge up to 36 per cent a year. If you need to borrow at all, then apply for a personal loan, which in general charges much less than a credit card. Borrowing causes stress, and stress is something you need to avoid. 16. Shop around Before buying something you need, shop around for a better price, especially for food, clothes, shoes, cars, and insurance. Just because the supermarket nearest your home is the most convenient, it doesn’t mean it sells the cheapest goods. Shopping can be extremely therapeutic and enjoyable, so instead of looking at it like a task, make a day of it. 17. Pin it up Developing a lifelong habit of saving and investing is not easy. It requires will-power and determination. Write down your goal and pin it up so you’re constantly reminded of it. Once this practice locks in and becomes automatic, financial success is virtually guaranteed. 18. Cut down spending on special occasions Buying presents is great, but don’t overdo it. Gifts that are well thought out are more appreciated than mindless ones picked on a trip to the mall. Keep your spending down on special occasions – birthdays, anniversaries and holidays such as Christmas. It’s always the thought that counts. 19. Avoid Credit cards Credit cards can either be your worst enemy or your best friend. But more often than not, they’re our worst enemy. They give us a false sense of security and allow us to spend money we don’t actually have so it’s best to avoid them. Credit cards also have the highest interest rates out of any borrowing mechanism from a bank. Live within your means and spend only what you have. 20. Pay your credit cards first If you do have a credit card the least you can do is to pay them off first and ensure you have zero balance each month. Paying the minimum is a trap as the outstanding balance remains the same. You’re essentially only paying off the interest to the bank if you do that. If you maintain a zero balance, you avoid coughing up to 3 per cent ‘finance charges’ per month, ‘credit shield’ and all other pointless charges. Doing so would allow you to save thousands, each year. 21. Build an emergency fund An emergency fund is helpful in case of unexpected misfortune – job loss, accident, death in the family. The rule of thumb here is to have an equivalent of three months of your salary kept aside as an emergency fund and within easy reach. 22. Don’t buy things on impulse If you fancy something, wait for 24 hours before buying it. Chances are you will realise you don’t actually want it. If you love window shopping, ignore shopping malls for a while – or altogether -- because window shopping often turns into actual shopping. Don’t allow yourself to be tempted. 23. Save on utilities Turn off appliances when they are not in use, switch to energy-saving lights and turn off the air conditioning when you leave the house. Even by placing a water-filled plastic bottle inside an average-size toilet flush tank to displace extra water will result in hundreds of litres of water being saved each month. Don’t let the water run when brushing your teeth, use a glass instead. Avoid taking extended showers or baths. Know when the peak-hour rates apply and avoid using home appliances during that period. Avoid disconnection and reconnection fees by paying your bills on time. All these add up. 24. Be realistic, even when you get a pay rise Don’t let a pay rise give you an excuse to upgrade or spike your expenses. Don’t ditch your small sedan for a Porsche just because a neighbour drives one. Don’t move into a nicer, bigger villa just because a friend lives in one. You can’t keep up with the Kardashians and come on, let’s be honest, you really wouldn’t want to. 25. Keep an eye out for discounts Take advantage of loyalty programmes that allow you to save points. Make use of discount coupons to buy necessities. These days, most shops have loyalty cards so sign up with hypermarket loyalty programmes that convert your points into cash. 26. Never bounce a cheque Bouncing a cheque in the UAE is a crime. If you use a cheque to pay rent or school fees, make sure they don’t bounce. Otherwise it will cost you dearly in charges, or even land you in legal trouble. 27. Get adequate insurance Make sure you and your loved ones get adequate insurance cover. If a medical condition or accident takes you away from work and you end up with a huge medical bill, insurance is a boon. When shopping for insurance, remember that the cheapest isn’t necessarily the best. Read the fine print. Some costs are necessary for your peace of mind if misfortune strikes. 28. Get a basic TV package With the amount of TV package options you have in this city, it’s easy to get lost and end up with a package that is well beyond your budget. People in Dubai work a lot. Most people don’t have much time to watch telly so it’s a waste to have 500 channels when you mostly watch 5 on a regular basis. Most basic packages have all you need. 29. Keep your phone bill down Landline rates are usually cheaper than mobile phone calls, so use your home phone instead. To save on international calls, use your smart phone’s messenger service to get in touch with friends and family abroad. Limit your phone calls. Sign up for discounted rates offered by local phone operators for international calls. Fridays are always a good day to call home in the UAE as they’re discounted. 30. Get Wi-Fi instead of a socket connection Even though a Wi-Fi connection is more expensive than the regular socket connection, in the long run it will save you more money on your phone bill as you will be using the Wi-Fi to connect to the web rather than using your phone data. 31. Consider downgrading If your rent is a quarter of your salary, you’re living beyond your budget and must try downgrading. It may be less comfortable, but if you want financial freedom and long-term peace of mind, it is definitely worth considering this option. If the cost of living goes beyond reach, there's nothing to be embarassed about downgrading your lifestyle. You're just being honest and true to yourself. 32. Use public transport More people are using public transport in Dubai now. Use the excellent Dubai Metro and try the improving public bus transport network. And walk more; it’s good for your health and your pocket. Only take a cab when it’s absolutely necessary. If you have a guzzler that also requires high maintenance, it’s time to ditch it. 33. Medicine Medicine can be expensive. Research home brands of products and shop around at different pharmacies for lower costs. Don't postpone seeing a doctor, or getting regular health checks. Get what you need – your health comes first. 34. Wash your own clothes Avoid using laundry services. It might seem cheaper when compared to your home country but it’s not really and it all adds up. Set your washing machine at the minimum water usage. When dry cleaning your clothes, stick to the outfits your washing machine could ruin. A growing practice in Dubai is to wash your clothes at home and call the neighbourhood pressing service. 35. Be frugal Question every expense. Be very careful with every fils, dirham, penny, paisa, centavo or pounds, especially if you’re at the beginning of your working life. The longer you hold on a buying decision, the better your decision will be and the price you will get at that time. 36. Don’t be a victim of Parkinson’s Law In finance, Parkinson’s Law is: "As the supply of a resource increases, so does the demand for that same resource." In other words, the more money you earn, the more money you spend; you go to fancier restaurants, live in a fancier place, buy pricier items, drive a bigger car, and give larger tips. In the worst case, your expenses even rise higher than your income. If you get a raise, view it as a greater opportunity to save, not spend. BONUS: Manage expectations well It's the most unfortunate thing: expats who had no clue about financial discipline going home broke — and infirm — after many years of toil. Or worse, serving jail time over financial troubles. Just because you're an expat worker, it doesn't mean your relatives' expectations must be met all the time. That every expectation to celebrate with lavish parties at home must be met. That you are obliged to bail relatives or a cousin-of-a-cousin-of-a-friend kind of relation out of every financial bind. The key is to manage your money well. Set savings and expense targets. Be willing to take the pain of sticking to them. The degree of your success or failure in meeting goals lies in your resolve to stick to them. Like relentlessly pushing yourself to follow an exercise regimen in order to reap its proven health benefits, there's no one else who can make it happen for you. It's never too late to start today. Gulf News, UAE. 13th May 2018

0 Comments

Leave a Reply. |

RSS Feed

RSS Feed